How rates work

Rates are set from the long-term plan, then reviewed through the annual budget.

Our long-term plan sets out the services we plan to provide and projects we plan to deliver over the next 10 years. It also lays out what we plan to do each year.

Every second and third year we update the assumptions and budgets through an annual budget process. We review the work we plan to do for the year ahead, how much it's likely to cost, and the total amount of revenue (including rates) needed to pay for it.

Building and maintaining infrastructure and delivering services to an entire city costs a lot of money. Charging rates is one way we pay for these services. If you own property in the city, you’ll pay rates on it. If you're renting the cost of rates will be part of your rent.

Rates are calculated partially based on the land value of properties within the city and whether they’re used as residential, commercial/industrial or rural properties.

Since 1 July 2024, part of the rates is also based on the capital value of the property.

How much each property owner pays also depends on types of services the property uses and how it is zoned. For example, if you’re connected to the city drinking water and wastewater systems, you'll pay for those. If you live in the country and have your own water supply, you won't.

There are two types of rates: targeted and general

Targeted rates are paid by ratepayers to fund a specific service. Some targeted rates are only charged to those who have access to the service. For example:

- drinking water for properties connected to the city supply

- wastewater treatment and discharge for those connected to the city’s network.

- kerbside recycling for those on the Council collection route.

Others are charged to all ratepayers. For example:

- rubbish and public recycling

- transport (including roads and footpaths and street cleaning)

- economic development

- housing and urban design.

Some of the targeted rates are a fixed amount for each property (or separately inhabited part of a property). Others are based on the capital value of the property.

General rates are paid by all ratepayers to fund services provided by the Council that aren't covered by a targeted rate or a specific fee (like building and resource consents, dog registration and parking). These services include things like:

- parks and recreation

- libraries

- pools

- emergency management (Civil Defence)

- community services

- cultural facilities.

Council's general rates are calculated based on the land value of each property. In addition, a uniform amount (called a uniform annual general charge) is charged to every ratepayer. This charge acts as a mechanism to ensure properties with very low land value pay at least a minimum amount and those with very high land values do not pay unreasonably high rates.

The value of your property is a major factor in how much you pay

New Zealand’s rating legislation requires councils to revalue properties every 3 years and to use these values as the basis for calculating rates for each individual property (where the council believes values are the best mechanism for sharing the rates among ratepayers).

The value of Palmy’s properties is set by independent valuer QV. The most recent citywide revaluation was 1 September 2024. The next one will be in 2027.

As part of the development of the annual budget for 2025/26 we will calculate the total rates required for next year. These will then be distributed among ratepayers based on the new values.

We'll provide information in March/April that will let you know the proposed new amount you'll be paying for the year beginning 1 July 2025.

The rating values as of 1 September 2024 are lower than 1 September 2021. This will not likely lead to a reduction in rates for individual properties.

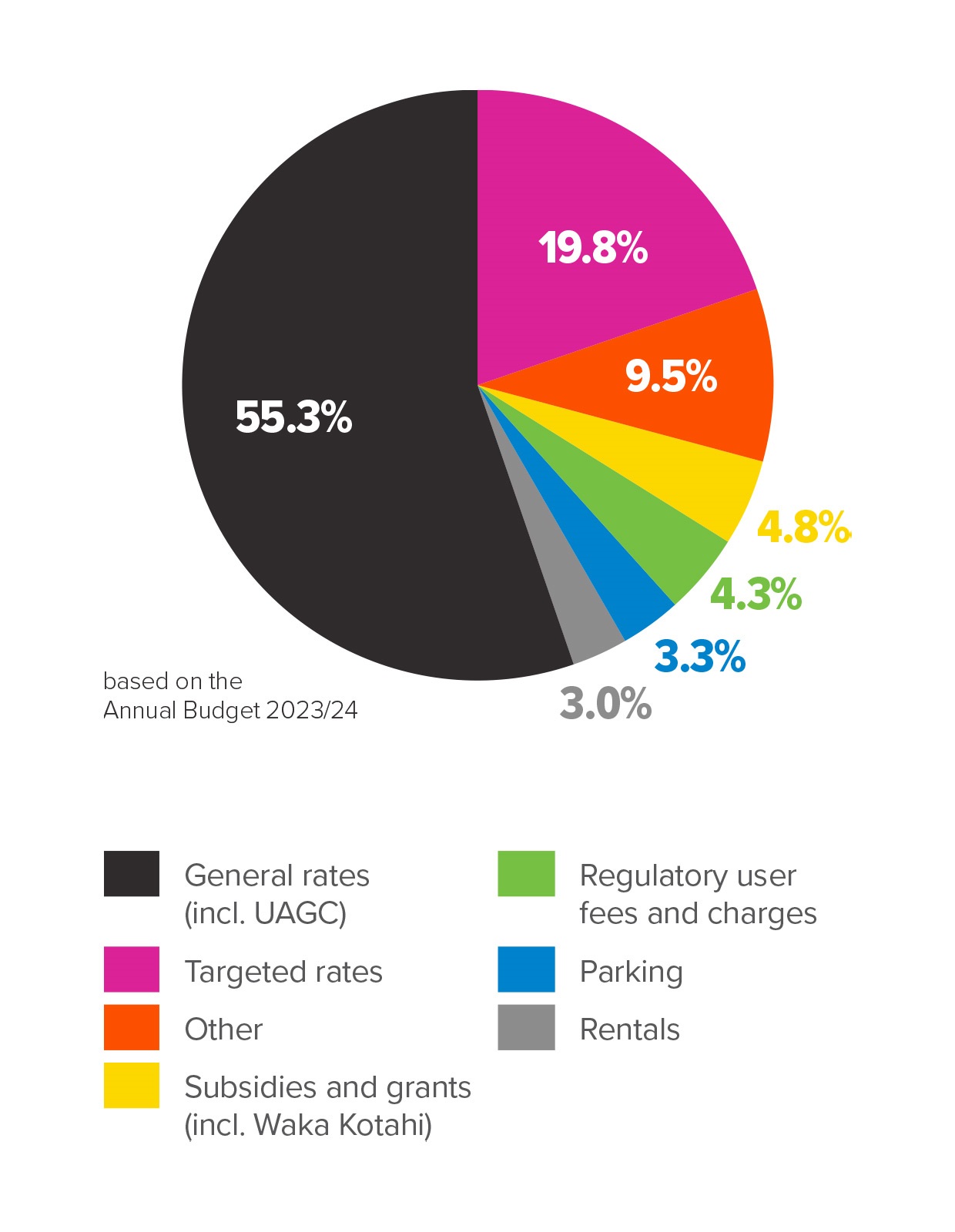

Rates only pay for around three-quarters of running Council

Rates are an important part of how we fund our city, but we don’t rely on rates alone. We also get revenue from a range of other areas. The chart below shows the percentage they contribute to running our city’s services and facilities.