How rates work

Rates are set from the long-term plan, then reviewed through the annual budget.

Our long-term plan sets out the services we’ll provide and projects we’ll deliver over the next 10 years. It also lays out what will be done each year.

Every year we then complete an annual budget which decides the work we’ll do for the year ahead, how much this is likely to cost, and the total amount of revenue (including rates) needed to pay for it.

Building and maintaining infrastructure and delivering services to an entire city costs a lot of money. Charging rates is one way we pay for these services. If you own property in the city, you’ll pay rates on it. If you're renting the cost of rates will be part of your rent.

Rates are calculated partially based on the land value of properties within the city and whether they’re used as residential, commercial/industrial or rural properties. The biggest factor in determining each property’s rates is the land value of that property. In general, the higher the value, the higher the rates.

How much each property owner pays also depends on types of services the property uses and how it is zoned. For example, if you’re connected to the city drinking water and wastewater systems, you'll pay for those. If you live in the country and have your own water supply, you won't.

There are two types of rates: targeted and general

Targeted rates are paid by ratepayers who receive a specific service. For example:

- drinking water for properties connected to the city supply

- wastewater treatment and discharge for those connected to the city’s network.

- kerbside recycling

General rates are paid by all ratepayers to fund services provided by the Council that aren't covered by specific fee (like building and resource consents, dog registration and parking). These services include things like:

- parks and recreation

- libraries

- pools

- emergency management (Civil Defence)

- community services

- cultural facilities

- roads and footpaths

- street cleaning.

General rates include an annual general charge. This is a uniform amount that is charged to every ratepayer. This charge can be adjusted higher or lower as a kind of lever to balance out the effect of jumps or declines in the valuation of properties carried out every 3 years.

The value of your property is a major factor in how much you pay

New Zealand’s rating legislation requires councils to revalue properties every 3 years and to use these values as a partial basis in calculating rates for each individual property. The value of Palmy’s properties is set by independent valuer QV. The most recent citywide revaluation was 1 September 2021. The next one will be 1 September this year. We'll let you know the new amount you'll be paying in December, and the first invoice at this amount will arrive in your letterbox in August 2025.

Through the annual budget process, the Council decides how much funding we need to run Council’s services for the financial year and how these costs will be portioned out through the rating system.

The most recent valuations saw the land value of Palmy properties nearly double on average (particularly residential ones). Some have risen much more than this, reflecting the fact that land anywhere in the city is becoming more and more valuable. The result has been that for those who’ve seen bigger jumps than average in the value of their land, their rates have risen more too.

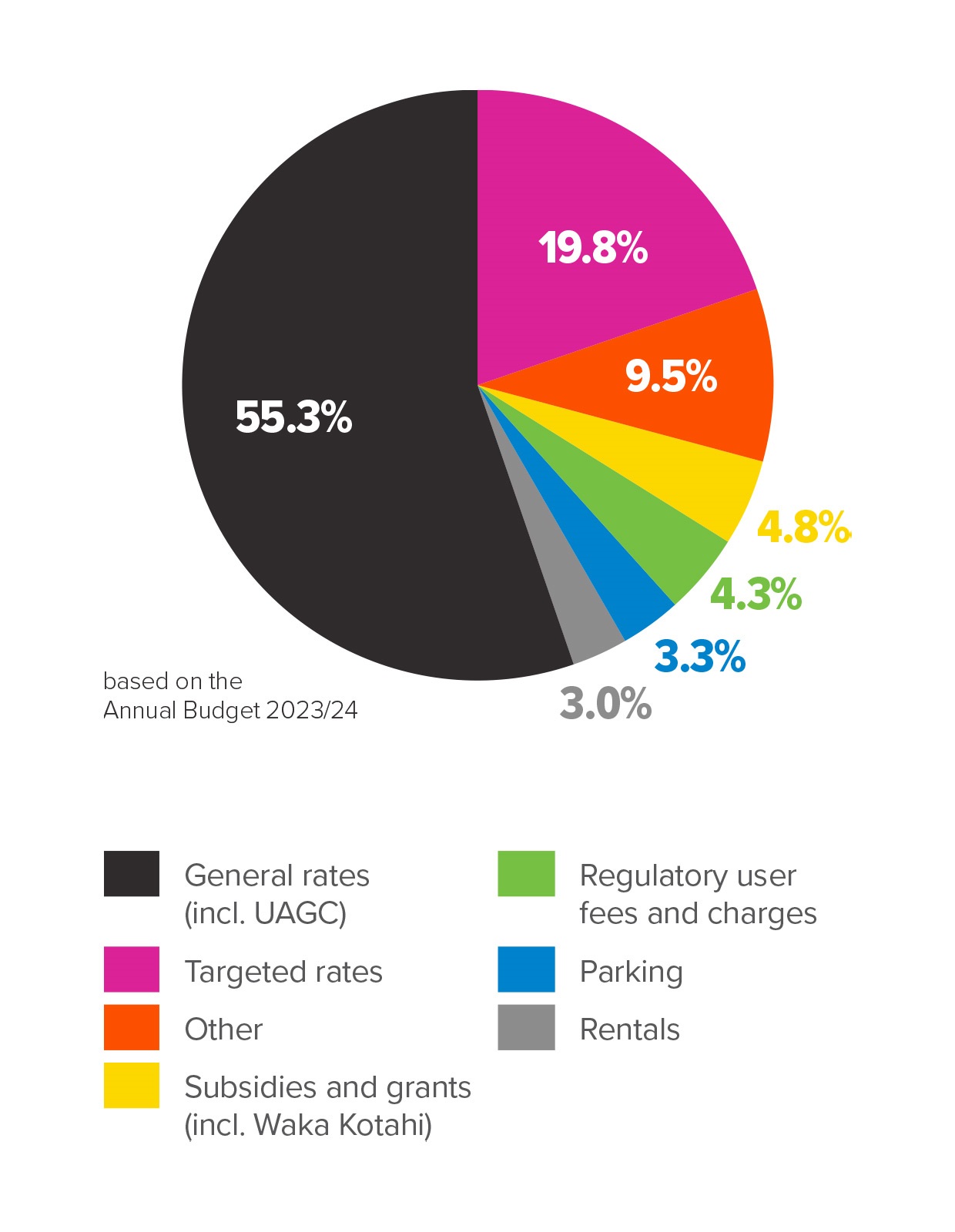

Rates only pay for around three-quarters of running Council

Rates are an important part of how we fund our city, but we don’t rely on rates alone. We also get revenue from a range of other areas. The chart below shows the percentage they contribute to running our city’s services and facilities.